In Digital Marketing, there are few numbers more important than your Customer Acquisition Cost (CAC). That is the cost of getting a new user to download your app, buy a product, or start a free trial.

The Customer Acquisition Cost is a benchmark number used to establish how effective your marketing efforts are and, therefore, is a very important number to know by heart.

We can calculate this metric by dividing all the costs spent on acquiring more customers by the number of gained customers. The result is one of the most important numbers to measure the health of a marketing strategy.

That is why today we are going to look into how to calculate it properly and what benefits a business can get knowing its Customer Acquisition Cost.

In this article you will find out:

- What is Customer Acquisition Cost?

- How to calculate CAC?

- What are the benefits in calculating your Customer Acquisition Cost?

- How to reduce Customer Acquisition Cost numbers?

Curious? Keep reading to find out the answers to these questions!

What is Customer Acquisition Cost?

Internet companies have their very own dynamic when it comes to acquiring customers. Mostly, they use web-based advertising campaigns to do so.

Those campaigns can vary in nature and performance. Some companies will reach their customers using pay-per-click ads and get great results with that effort.

Others will prefer strategies that include Inbound Marketing and Content Marketing to reach out to customers organically.

No matter how your company gets in touch with consumers, you spend money doing so. The Customer Acquisition Cost is a way to look into how much money is being spent to turn a lead into a client.

We can calculate the Customer Acquisition Cost for every campaign your business does for acquisition, and we can use this metric for many purposes.

One of them is showing investors and stakeholders how well the company manages to convert its prospects and how many clients it can reach in the future following the same recipe.

The Customer Acquisition Cost can also determine a company’s profitability. That’s why this is such a hyped up number of marketing since the dawn of the internet.

How to calculate CAC?

While the Customer Acquisition Cost is a powerful key performance indicator for business, it isn’t hard to calculate. But, to be able to do so effectively, you will need to know a few things beforehand.

First, let’s look at its formula:

CAC = Total Cost of Marketing Expenses / # of customers acquired

Customer Acquisition Cost’s formula is to divide the costs spent on acquiring more customers by the number of customers acquired in that period. But to get a precise calculus, you need to make sure that it accounts for all your marketing expenses.

That can be as simple as making sure you have the right numbers for your pay-per-click campaigns. Or more complex, like calculating the cost of a long content development campaign for your blog or website.

Make sure you have all your figures at hand before you start calculating the CAC of your campaigns.

What are the benefits in calculating your Customer Acquisition Cost?

Customer Acquisition Cost is a key metric for any business because it will help you tell how important a customer is for your company. Here are some reasons why you will want to pay close attention to this metric.

To simplify decision making

It’s hard to talk about Customer Acquisition Cost without talking about another important KPI: The Customer Lifetime Value.

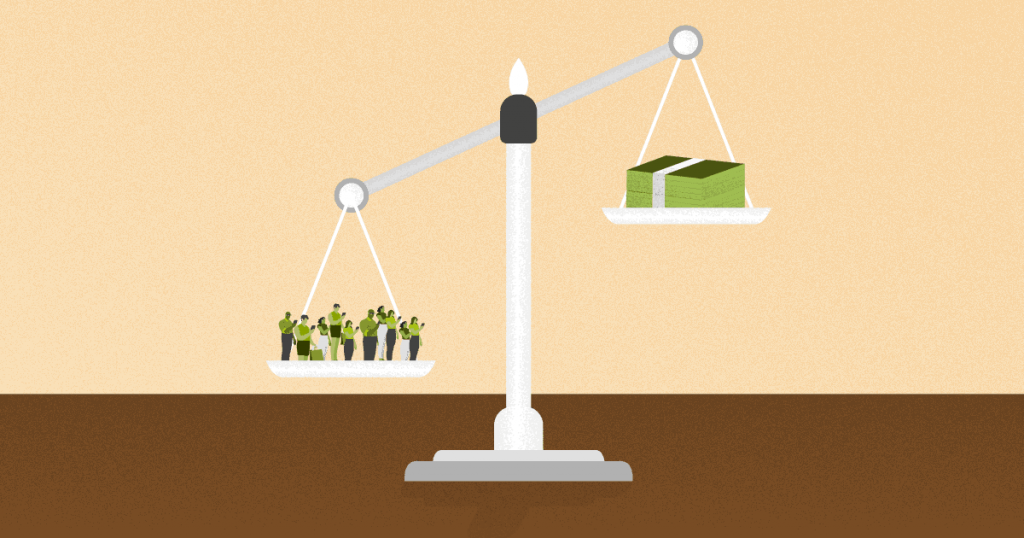

The key to a business is to balance the total sales as marketing costs to get new customers with the revenue they generate for your company.

Because of that, calculating the CAC is an important way to simplify decision making in your business.

When you look at the price to acquire new customers, you can deduce which of many strategies works best and save time when building your next ad campaigns.

To optimize your marketing strategy

Since we’re talking about Customer Lifecycle Value, we must talk about marketing strategies.

A marketing strategy is your business game plan for reaching prospects and turning them into customers. To work, you must make sure your customers are profitable, and using those two metrics together, you can.

Comparing the ratio between Customer Lifecycle Value and Customer Acquisition Cost your marketing team will be able to tell what to prioritize and how to better spend its budget.

To determine your payback period

Last but not least, we must look into how the Customer Lifecycle Value and Customer Acquisition Cost ratio helps to determine another important number: your payback period.

After investing money in reaching out to new customers, it is only natural that your company wants to know when it can start profiting from them.

With both those numbers in hands, it’s possible to tell when your business will get cash from the conversions generated with a marketing campaign.

How to reduce Customer Acquisition Cost numbers?

Is your Customer Acquisition Cost too high?

According to the experts, that can be a startup killer. If a business model has a high CAC, it can have problems thriving in the market.

That’s why now that you are aware of Customer Acquisition Cost and its importance for business success, that you must learn the ways to reduce it.

Check out some tips on how to do just that!

Optimize the sales funnel

The first step to improve your Customer Acquisition Costs is to optimize your sales funnel.

Quantify each step in the process and strike to understand how many of your visitors turn into leads, leads into opportunities and opportunities into customers.

This will help you find out which parts of your current sales funnel aren’t working effectively and get some ideas on how to change that.

Try Inbound Marketing

Some strategies are more successful than others in reducing Customer Acquisition Costs, and Inbound Marketing is a big champion in saving money.

While building content strategies is an expensive task, providing long time value for your prospects is a great way to bring in leads.

What makes Inbound Marketing so successful is how long it can bring leads to your business.

A great piece of content can work for long periods of time and reach new customers every day without the need to throw any more money at it — like you’d have to do with pay-per-click campaigns.

Better your pricing strategy

Perhaps your company is having a hard time with conversions because of your pricing strategy.

If it’s too complex, clients will have difficulty making a quick decision to buy and might postpone it until they forget it.

Or maybe your current pricing strategy doesn’t guarantee enough money upfront for your customers, which makes you spend more money to reach out to new people. Ensure you start making profit as soon as you can; that’s the best pricing strategy.

Perform A/B tests

Maybe your whole acquisition strategy is what is making acquiring new customers such an expensive task.

That’s one of the reasons why we perform A/B tests in marketing: to check out if a couple of changes in strategy can gain big results.

For all your campaigns, perform A/B testing. It will help you tell what works and what is most cost-effective for your company.

Improve your landing pages

How good are your landing pages at acquiring new customers? Developing objectively better landing pages is a great way to make sure your CAC goes down.

A better landing page is one that converts more per click. It is speedy and efficient, with only the text your customer needs to decide at that moment.

Review your landing pages to make sure they fit the bill and compare your customer acquisition costs after making changes towards efficiency.

Use a CRM system

Does your company reach out for repeat buyers and is having trouble making the CAC of those campaigns stick to a low number? It is probably time to invest in a CRM system.

A CRM system will help you keep track of your repeat customers and how to reach them.

Today, there are many cloud-based options of CRM systems that can be used by the whole marketing and sales team in order to build a strategy to spend less in gaining the attention of those repeat customers.

The Customer Acquisition Cost (CAC) is an important metric for startups, but it isn’t the only one that matters. Make sure you know your KPIs and how to combine them to better understand how your business is going and how it can improve over time.

Now that you know how to calculate your Customer Acquisition Cost and how important that metric is for business, find out more about how Customer Loyalty can help your company succeed. Check out “Customer Loyalty: why your company needs a loyalty program and 5 brands to inspire “!

![[Rock NA] State of Marketing Reports 2024 – Comkt Hubspot State of Marketing Report 2024](png/banner-fino-rock-convert-2500-%c3%97-500-px-19.png)